December 27, 2023

You’re starting a business that involves other owners, investors or family members – everything is great.

All parties get along fabulously and are aligned to the goal of making this new venture a success.

You can’t imagine anything going wrong.

I can’t tell you how many times I’ve heard that sentiment from owners, only to see things go awry over time.

It happens for many reasons – conflict around vision, goals and values, lack of communication, business challenges or successes, money squabbles, etc.

The unhappy truth is that messy breakups abound in business – consider Facebook or The Beatles.

As a business and exit planning consultant, one of the best pieces of advice I give owners is to plan for the worst and hope for the best.

This is especially true when it comes to having your business agreements well thought out and executed before starting a business.

With proper planning, you’ll not only have a clear understanding of how the business will be operated but also how you or others can exit if it doesn’t go well.

So, what agreements should you consider having in place for your business, if you don’t already have them?

Here’s a look at some of them:

Shareholder (stockholder) agreements

If there is more than one owner, I suggest a shareholder agreement that describes how a company should be operated and outlines the shareholders’ rights and obligations.

It is also intended to make sure that shareholders are treated fairly and their rights are protected.

In addition, it allows shareholders to make decisions on whether outside parties may become future shareholders and provides safeguards for those holding a minority interest.

Where does the shareholder agreement come into play?

Let’s say you are a minority owner in a business, and you want to exit.

The agreement can outline the mandatory or optional buy-back by the company of your shares. It can also outline that an owner can’t sell to an outside party without giving the other shareholders or company the right of first refusal.

It can also provide details on how the value of your shares is calculated should a buy-out occur.

Now, if you’re a 50/50 owner, another item that you may want to incorporate is a mandatory option to buy out the other shareholder after some time.

In a 50/50 ownership situation, if the parties aren’t getting along and can’t come to an agreement, without some forced option to exit out a shareholder or force the sale of the business, there is no exit.

This is typically where lawsuits ensue.

Again, plan for the worst and hope for the best.

Buy-sell agreements

This agreement stipulates how an owner’s share of a business may be reassigned if that partner dies or otherwise leaves the business, typically through disability or retirement.

This agreement may also establish how value is determined depending on the reason for exit.

Many times, these agreements are funded through life insurance policies to provide the cash for the business to repurchase a deceased owner’s share.

Operating agreements

This agreement is used to define the financial and functional decision-making within a limited liability company.

It provides clear governance on internal operations according to the rules and specifications defined by the owners.

A previous client ran an LLC where there were four equal owners.

All were family members but from two different families.

The individual roles/positions they held in the business were very different, from president to purchasing manager.

Because they were equal owners, they all thought they had equal decision-making when it came to the operations of the business.

Without a clear operating agreement, separating ownership from functional, decision-making could be a bone of contention.

Partnership success

The shareholder, buy-sell and operating agreements are some of the more common and critical agreements business owners should look at putting into place in their businesses.

Thinking through all the potential situations and circumstances as you’re drafting the documents can provide clarity, prevent disputes and create continuity of the business.

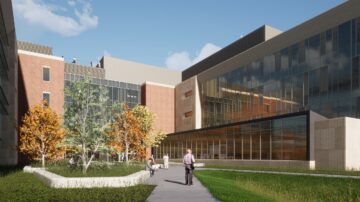

UWL secures funding to complete Prairie Springs Science Center

UWL secures funding to complete Prairie Springs Science Center Making IT personal for 25 years

Making IT personal for 25 years