October 20, 2025

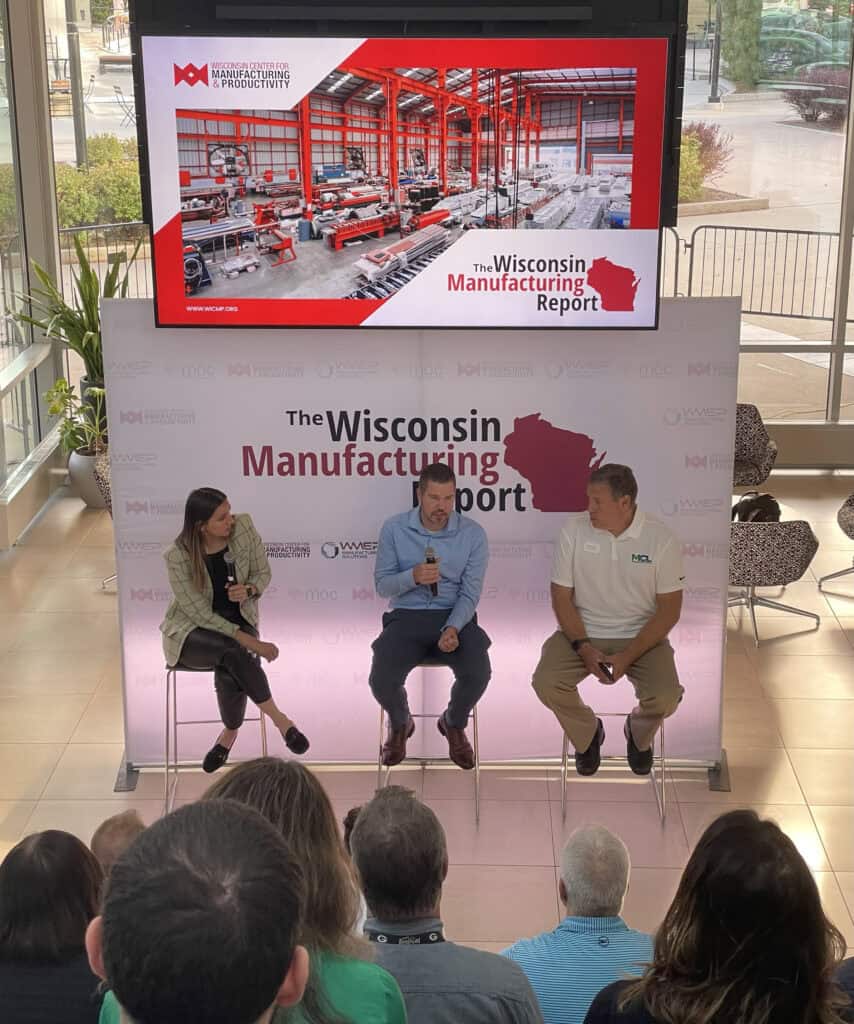

WISCONSIN – TitletownTech recently played host to the Wisconsin Center for Manufacturing & Productivity (WCMP) presentation regarding the strength of, and challenges facing, one of the state’s top professional industries – manufacturing.

The 2025 Wisconsin Manufacturing Report – presented by WCMP’s executive director and CEO, Buckley Brinkman, and Meeting Street Insights Founder Rob Autry – highlights five key takeaways:

- A rise in manufacturers’ economic confidence

- Easing workforce challenges

- The implementation of AI

- Impact of tariffs

- Key factors driving their future growth

In addition to highlighting the report’s sponsors, Autry – “one of the nation’s leading pollsters and research strategists,” according to the Meeting Street’s website, meetingst.com – gave special recognition to the hundreds of manufacturers who participated in this year’s survey.

“We had 405 of you who spent about a half hour with us on the phone – giving us your ideas, your opinions, your thoughts – and it’s your voices that are bringing this report to life,” he said.

Because this is the fifth year WCMP has commissioned the state-based study, both Autry and Brinkman said they are starting to identify trends in manufacturers’ responses.

“It’s exciting, because we’ve seen some of the trends start to form, and we can dive even deeper on some of the insights that we have,” Brinkman said.

Economic confidence, workforce challenges

Each year, Autry said Meeting Street and the WCMP interviews “executive leadership – [people] who make decisions for manufacturing companies” – from across the state to gather data for the manufacturing report.

Following the survey, Autry said the two organizations conducted “a series of in-person focus groups” with manufacturing executives to “better understand some of the findings.”

Autry said per the report, “confidence in the business climate, confidence in the economy [and] confidence in their own individual companies” are on the rise, as are gross revenues and profitability.

“It’s only the second time over the five years we’ve done this [study] that [there] is [a] net positive [response] in terms of the direction of the economy,” he said. “Thirty-two percent of manufacturers this year say they believe the economy of Wisconsin is growing – that’s up from 23% a year ago.”

The report further states that manufacturers’ “financial confidence is up across the board,” but is especially high this year among smaller companies.

“Ninety percent of manufacturers say they are optimistic about the future of their own company,” Autry said – adding that they believe the state’s economy, even in uncertain times, “has been really consistent.”

“When Rob first gave me this data, it stunned me, because with everything that’s going on [with] the economy, I was amazed that people could be that optimistic,” Brinkman said. “They absolutely are confident in the economy, in their own operations and their ability to take advantage of the opportunities that are presented to them.”

However, one area Autry said Wisconsin’s manufacturers continue to struggle with is the industry’s declining workforce.

When answering an open-ended question regarding issues affecting their company’s future success, the report states that 40% of survey respondents reported “finding quality and skilled people/employee retention” as their top concern – followed by tariffs and inflation/rising costs, 23% and 19% respectively.

Even though workforce challenges remain a “top concern for manufacturers,” Autry said the study states “the labor market is softening” and they are “generally less concerned.”

“In fact, there are several areas where we saw noticeable declines in concern,” he said.

Per the report, the percentage of manufacturers that find it “very difficult… to find qualified workers” is down from 57% in 2021 to 31% this year, but only down 1% from 2024.

“It’s down 26 points over the last five years, and that decline is occurring with every type of manufacturer, but it is particularly pronounced with the larger manufacturers – those with more than 50 employees,” Autry said. “[So], for the most part, concern levels have been a little bit down in 2025 compared to 2024.”

To address these long-term workforce challenges, Autry said “six out of 10 manufacturers” report “increasing wages and salaries” as something they’re “changing or considering.”

“Smaller manufacturers are primarily focused solely on increasing wages and salaries and offering employee training,” he said. “When you look at the larger manufacturers, who tend to be more concerned about workforce-related issues, they have more of an all of the above approach.”

Other top changes manufacturers said they are considering, per the report, include “offering training, automating and raising prices.”

The report further states that roughly the same number of manufacturers between 2024 and 2025 are hiring, but there are overall fewer job openings at each company – with 19% reporting they were hiring for more than 10 open positions in 2024 as compared to 15% reporting the same in 2025.

“As we look forward, we think [the workforce] issue is going to be around for the next 10 years – the demographics are just not in our favor,” Brinkman said. “But manufacturers are really hanging on to the employees they want to keep. So, the employment market is still really sticky.”

AI implementation, impact of tariffs

Compared to years past, Autry said there have been “big increases” in manufacturers’ utilization of artificial intelligence (AI) and automation.

“Utilizing artificial intelligence is up 10 points from where it was a year ago,” he said.

In 2024, per this year’s report, 64% of respondents said automation is important to their company’s future as compared to 72% in 2025.

“[Among] larger manufacturers – those with more than 50 employees – 94% say automation is important to their future, but so do two-thirds, or 65%, of the smaller manufacturers as well,” Autry said.

However, Autry said some manufacturers are struggling to find their “starting line,” and are facing numerous obstacles – holding them back from investing in the new technology.

“About a third of all manufacturers say their biggest obstacle to implementing automation is financing; 21% mentioned technology or systems obstacles; [and] another 16% mentioned training obstacles,” he said. “Forty-one percent reported no obstacles.”

In the report, respondents who said AI wasn’t important decreased from 36% in 2024 to 28% in 2025, and the number currently using AI has “tripled since 2023” – from 10% then to 35% this year.

“So, [we’re seeing] significant changes as more and more manufacturers began to use and consider the use of AI,” Autry said.

There are four main areas, he said, where manufacturers said there were obstacles to using and implementing AI:

- A lack of internal expertise

- Difficulty integrating existing company data

- Upfront investment costs

- Being uncertain about the ROI of AI

“Manufacturers are actively pursuing opportunities in the marketplace, and they’re using technology smartly within their business to improve their productivity,” Brinkman said. “They’re really finding two places where they’re getting hung up on implementing it. One is that they just don’t want to start – so we’re trying to make that much easier for them to take that first step – and the second area is finding an ROI that’s acceptable on the investments they’re making.”

Some of the largest investments that manufacturers are expecting to make soon, per the report, are in “maximizing productivity; systems, technology and automation; workplace and company culture; and expanding sales within the United States.”

Among responses, Autry said finding new customers and markets is believed to be key in driving future growth, “particularly in the United States.”

“More and more manufacturers are looking in their backyard for new prospective business,” he said. “A year ago, 80% said the United States was part of the world where they saw the greatest increase in prospective business. Today, it is at 87%, and while that may not seem like a huge jump over the span of one year, that data has been remarkably flat for the previous four years.”

Autry said a new topic included in this year’s report was the impact of tariffs on Wisconsin manufacturers.

“Here’s kind of the key stat: 72% of manufacturers said they have been impacted by tariffs… and at the top [cause] of this [impact] was cost increase,” he said.

The report states that manufacturers in Wisconsin are “divided on whether trade negotiations will help or hurt them” – with 28% reporting they would “help” their business, and 26% reporting it would “hurt” their business.

The report further states that “manufacturers expect revenues and productivity to increase, but uncertain market conditions slow capital expenditures.”

“The vast majority have been impacted, and they tend to be the bigger manufacturers, in particular,” Autry said.

After discussing the topic with manufacturers from across the state, Brinkman said companies can be “broken into three groups” regarding their attitudes surrounding the tariffs – the first being “the group where tariffs are actually helping their business.”

“The second is [where] tariffs are hurting their business, but as long as China feels the pressure, feels the heat and gets a little bit of punishment, they’re happy to make that sacrifice,” he said. “Then there’s a third group that believes these tariffs are going to help bring manufacturing back to the U.S. – so it hurts their business, but they’re willing to make that an investment for the good of the industry.”

Panel discussion, wrap up

Following Autry and Brikman’s presentation, Kathryn Clouse – director of co-innovation at TitletownTech – led a panel discussion with Packer Fastener CTO Bill Feck and Village Companies Lead Engineer Mark Johnson, in which they discussed the two executives’ experience in implementing AI into their respective companies’ processes.

“It is important for us to be thinking about what is on the minds of [the professionals leading] one of our most powerful economic drivers in the state – the manufacturing industry,” Clouse said, emphasizing the start-up hub’s relationship with the WCMP.

“The WCMP is an organization we’ve had a chance to work with a little bit closer this past year, but have had a many-years-long relationship with their leadership,” Clouse said.

The WCMP’s annual manufacturing report, Brinkman said, “is the No. 1 source for manufacturing information” in the state, and since the beginning, “a significant number of manufacturers [have reported being] under some pretty serious stress.”

“During these relatively good days for manufacturers, they haven’t gone out of business, but… we’re worried about this 20% or so – the manufacturers that are under stress – that we might lose a significant number of them,” he said.

When considering the study’s results overall, Brinkman said three important pieces of advice manufacturers should consider are to invest in their workforce, prioritize productivity and embrace AI.

For the full report, visit the WCMP’s website – wicmp.org.

Lakeside Foods acquires Oregon-based Smith Frozen Foods

Lakeside Foods acquires Oregon-based Smith Frozen Foods Providing customers with ‘sunshine after sunset’

Providing customers with ‘sunshine after sunset’