November 18, 2024

NORTHEAST WISCONSIN – The regional paper industry is no mere sheep in wolf’s clothing.

Per the Wisconsin Historical Society, it’s been more than 150 years since a wood pulp mill began operating in Appleton – the genesis of an illustrious industrial run throughout Northeast Wisconsin.

However, the paper industry has hardly rested on the laurels of its storied past, as evinced by insights from this fall’s Economic Intel Forum – a twice-annual event hosted by St. Norbert College (SNC) in partnership with New North, Inc.

The topic for the recent forum was Wisconsin’s paper and converted products industry – an industry that directly or indirectly contributes billions to the state’s economy.

Among the featured speakers, included Secretary David Casey and Chief Economist John Koskinen from the Wisconsin Department of Revenue who provided economic reports with regional, statewide and national context, and Georgia-Pacific Operations Manager Dean Wesolowski who spoke on behalf of the company’s recent expansion and ongoing investment into Northeast Wisconsin’s paper industry.

The speakers focusing on manufacturing and the paper industry’s regional significance were Marc Schaffer – SNC professor and executive director of the SNC Center for Business, Economics & Analytics (CBEA) – and SNC CBEA student fellows Faith Fehrman and Adan Martinez-Ponce.

The goal of the forum was to give an update on the state of the paper industry in the region.

Paper trail: Following the trends

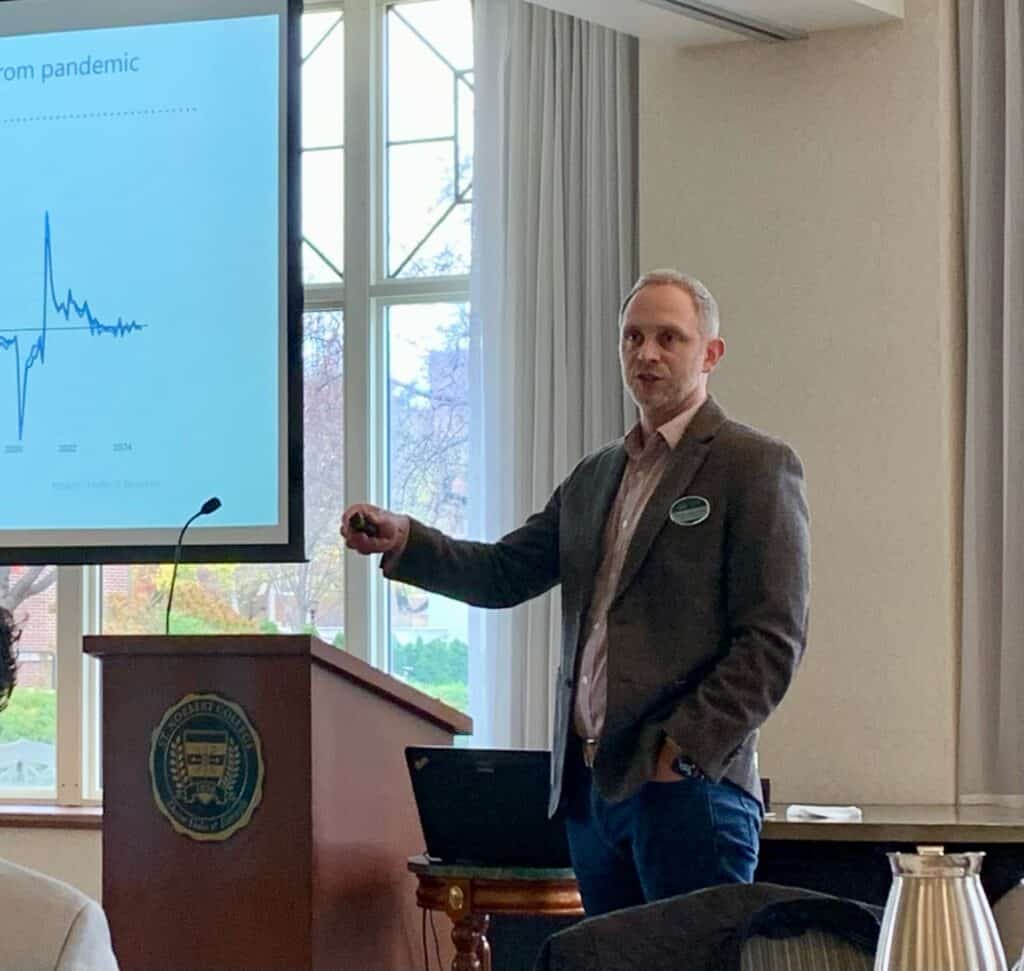

Sizing up American manufacturing as a whole, Schaffer said national production has normalized following the volatility of the COVID-19 pandemic, though it has become sluggish over the last year and a half (per statistics from the Federal Reserve).

Schaffer said the Institute for Supply Chain Management’s Purchasing Managers Index (PMI) corroborates these signs of contraction in manufacturing nationwide, as he offered a potential explanation.

“Some people are pointing to – which is common in election years – a lot of uncertainty in general,” he said. “People hold back, businesses hold back on some big investments and things with uncertainty. But, long story short, national manufacturing is just a little soft right now – a little subdued.”

Though manufacturing has largely resumed its pre-pandemic production levels, Schaffer said national paper production has lagged (per the Federal Reserve).

He said his theory for this incongruence regards consumer behavior as influenced by the conditions of the pandemic.

During that time, Schaffer said collective spending temporarily shifted to durable and nondurable goods rather than services, unavailable as they were.

Another reason unrelated to COVID, Schaffer said, has been readers choosing digital over printed publications, thus lowering demand for wood pulp.

He said the Federal Reserve reported not all paper products have behaved equally recently, referring to the North American Industry Classification System (NIACS) classifications:

Pulp, paper and paperboard mills:

- Pulp mills

- Paper (except newsprint) mills

- Newsprint mills

- Paperboard mills

Converted paper product manufacturing:

- Corrugated and solid fiber box manufacturing

- Folding paperboard box manufacturing

- Other paperboard container manufacturing

- Paper bag and coated and treated paper manufacturing

- Stationery product manufacturing

- Sanitary paper product manufacturing

- All other converted paper product manufacturing

“That converted paper sector is consistently holding very strong compared to everything else,” Schaffer said. “There’s where you see even more resilience for this sector, which bodes well for our region in the converted paper part of the conversation.”

Citing the U.S. Bureau of Labor Statistics (BLS), Schaffer said national paper industry employment trends have similarly followed those of output, dipping over the last two years and “a little bit softer than broader manufacturing as a whole.”

It’s worth underscoring, Schaffer said, these are national statistics rather than simply Wisconsin’s – and “there are a lot of things in our state that are bucking trends.”

Pulp facts: Employment and wages

Schaffer said the BLS’s numbers show American manufacturing output trends roughly resemble those of national manufacturing employment levels.

Less similar, he said, has been the comparison of employment wage growth between the overall U.S. job sector versus manufacturing, per the Federal Reserve Bank of Atlanta.

“If you go back to the ‘90s up through sort of the (2007-08) financial crisis, what you see is manufacturing (wage) growth – while it was increasing – was lagging (behind) the national growth in wages,” he said. “But if you notice, (manufacturing) kind of hit our long expansion following the financial crisis – it definitely did some catch-up and picked up a little bit faster than the rest of the country. We had some softness initially when the pandemic happened, followed by a pretty strong pickup in wage growth, as we were in that phase of recovery from the pandemic phase, which is good.”

Focusing on the BLS’s numbers from 2023, Schaffer said the breakdown of average annual wages was:

- All U.S. industries: $72,608

- U.S. manufacturing: $82,575; Wisconsin manufacturing: $69,022

- U.S. paper manufacturing: $78,666; Wisconsin paper manufacturing: $76,663

- U.S. pulp, paper and paperboard mills: $96,363; Wisconsin pulp, paper and paperboard mills: $83,524

- U.S. converted paper: $72,906; Wisconsin converted paper: $73,728

“(Wisconsin) paper is basically higher than the national average (salary for all industries), which is a good thing for workers in this industry,” Schaffer said. “We have a lot of jobs in this area – a lot of really good companies doing some really good things that are paying really good salaries, which bodes well for our region.”

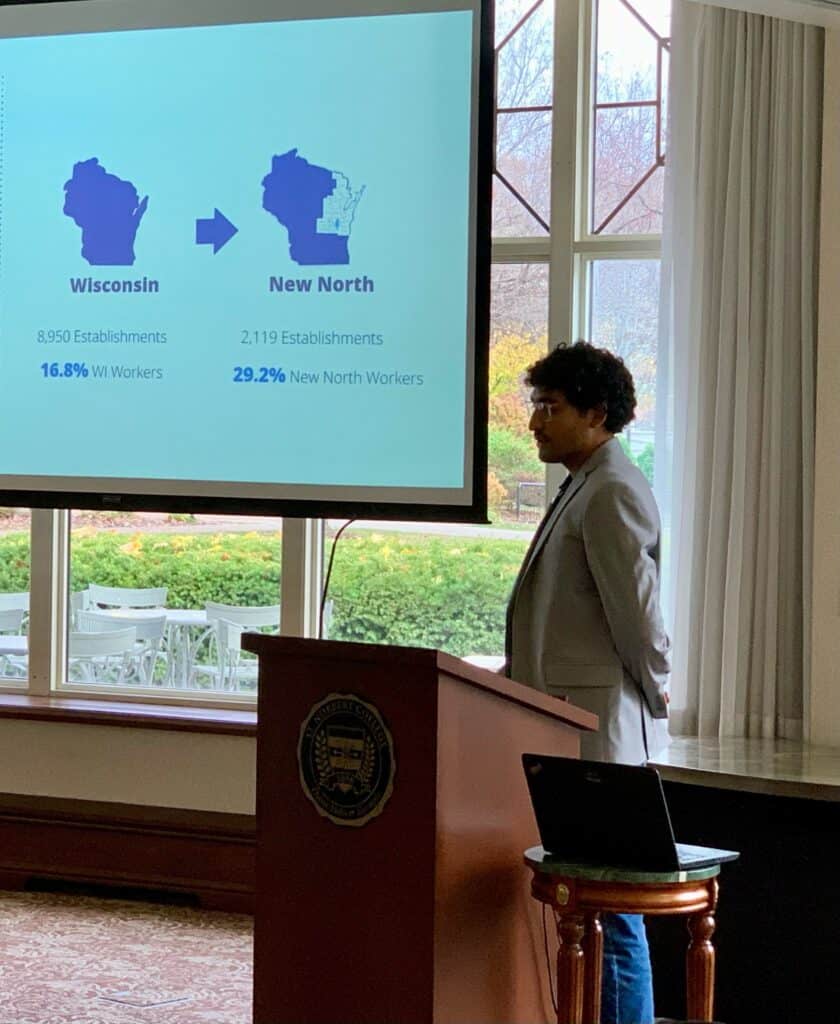

Compared to national numbers, Fehrman said the paper industry in Wisconsin is “well above average” not only in terms of wages but also regarding employment.

Wisconsin employs an outsized percentage of the country’s manufacturing workers, she said, with 16.8% of the state’s workers employed at one of its 8,950 manufacturing establishments – compared to 8.5% of U.S. workers employed at one of America’s 400,475 manufacturing establishments.

Fehrman said as of March 2024, the BLS reported Wisconsin has the country’s highest concentration of paper industry employees – 1.07% of workers statewide versus 0.271% nationally – with totals of 26,492 paper industry workers:

- 7,714 employed in pulp, paper and paperboard mills (second highest among all states)

- 18,778 employed in converted paper product manufacturing (fourth among all states)

“Something interesting about the converted paper (workers) – California is No. 3 in this, having only 600 more employees than Wisconsin in this industry, but (California) is more than six times the size in terms of population,” she said. “Wisconsin still being able to compete with some of these larger states in terms of number of employees in this industry – even though we have a much smaller population size – shows how important paper manufacturing is to our state.”

That significance only increases by further focusing on Northeast Wisconsin, Martinez-Ponce said, where 2,119 general manufacturing establishments employ 29.2% of the region’s workers.

“Wisconsin was almost double the national average, and the New North is even almost double again (compared) to Wisconsin,” he said of the percentage of manufacturing employees.

Citing BLS statistics, Martinez-Ponce further said the Badger State has 219 paper establishments, accounting for 26% of the country’s, meaning “one in every four paper establishments in the nation is right here in Wisconsin.”

Martinez-Ponce said the state’s three counties with the most paper establishments are all located in the New North:

- Brown: 30 establishments; 5,188 employees

- Winnebago: 29 establishments; 4,664 employees

- Outagamie: 21 establishments; 2,400 employees

These numbers aren’t only impressive statewide, Martinez-Ponce said – the three counties rank in the top 10 nationwide for paper industry employees, with Brown and Winnebago only tailing Cook County, Illinois, and Los Angeles County, California.

“Cook County has a population of five million, and Los Angeles County, of course, has a population of 9.6 (million),” he said. “Little old Brown County here has a population of 275,000, so that kind of puts it into perspective how important this New North region is for the nation.”

Preaching for the converters

Martinez-Ponce said paper is vitally important to Northeast Wisconsin, whether citizens work in the industry or not.

Citing the New North’s numbers, he said the regional paper industry accounts for $2.8 billion worth of output, $1.14 billion in sales within the region and 60% of Wisconsin’s labor, labor income and economic impact from the paper industry.

“It’s critical that companies like Georgia-Pacific continue to invest and innovate here in our counties,” Martinez-Ponce said. “It’s so very important to this part of the state.”

Business support is critical to alleviating blood shortages

Business support is critical to alleviating blood shortages Bull-ieve me – the rodeo is coming to West Central Wisconsin

Bull-ieve me – the rodeo is coming to West Central Wisconsin